Investing can be exciting and scary at the same time. Even when there is a chance to make a lot of money, there is often a risk involved. But not every trader deals with risk the same way. This is where the idea of “investment risk tolerance” comes in.

Risk tolerance is how ready and able someone is to deal with changes in the value of their investments in order to get a possible return.

You need to know how much risk you are willing to take to make smart business choices that fit your financial goals and level of psychological comfort.

This detailed guide will discuss risk tolerance in great detail, examine how it affects business plans, and give you tips on how to evaluate and handle your own risk tolerance correctly.

Come with us as we break down the complicated world of investment risk tolerance and give you the tools to feel confident in the financial markets.

What Does Investment Risk Tolerance Mean?

Investment Risk Tolerance is how much risk an investor is willing to take when the value of an investment goes up and down. It has a big impact on how people choose to spend their money.

Some important things to remember about risk tolerance:

How to Understand Your Risk Tolerance:

All investments involve some risk. Figuring out how much risk you will take helps you plan your investment portfolio.

Investors are usually divided into three main groups based on how much danger they are willing to take: aggressive, moderate, and conservative.

You can find risk tolerance tests online, such as risk-related quizzes or surveys.

The volatility of different financial tools can also be found by looking at the past returns for different types of assets.

Things that affect risk tolerance:

Time Horizon: How much risk an investor is willing to take depends on how long they plan to hold a property. Having longer-term goals may let you invest in risky things.

Financial Situation: Your risk tolerance is affected by things like your ability to earn money in the future, your other assets (like a home, a pension, or a gift), and your stable sources of money.

Size of the Portfolio: People with bigger wallets tend to be more willing to take risks since the chance of losing money is lower.

Aggressive Risk Tolerance: Aggressive Investors are ready to lose money to get better results.

A lot of the time, they know how the market works and how volatile stocks can be.

Aggressive strategies try to get returns that are bigger than average.

Conservative Risk Tolerance: Conservative investors are less willing to take risks.

They look for investments that will give them a guaranteed return and put protecting their cash first.

Often, bonds, bond funds, and income funds are part of conservative strategies.

Remember that everyone has a different risk tolerance, and ensuring that your investments fit your financial goals and level of comfort is essential.

Factors Influencing Risk Tolerance

Several essential things affect your risk tolerance, or how much uncertainty you can handle in your investments:

Personal Financial Situation: Your present financial situation is a big part of determining how much risk you are willing to take. How much risk you can easily take depends on things like how stable your income is, how much money you have saved, and how much debt you have.

Investment Goals: Your financial goals affect how much risk you are willing to take. Your goals, whether short-term, like buying a house, or long-term, like planning for retirement, will determine how much risk you are willing to take.

Time Horizon: One of the most important things to consider when figuring out your risk tolerance is how long you have to spend before getting your money back.

People with longer time views can usually take more risks with their investments because they have more time to recover from possible losses.

Psychological Factors: The way you think and feel also has a big impact on how much risk you are willing to take. How much risk you’re ready to take in your investment journey depends on how comfortable you are with uncertainty, how you’ve dealt with setbacks in the past, and how you feel about money.

You need to understand these psychological factors to set a risk tolerance that works for your general financial health.

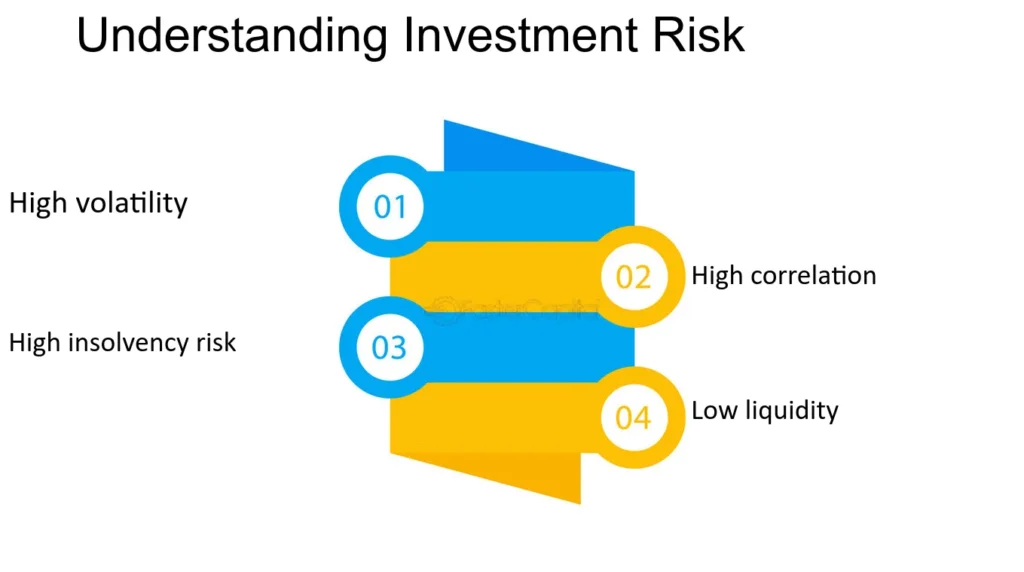

Types of Investment Risk

When looking for investment options, it’s important to know the different kinds of risks you might face:

A. Market Risk: Market risk, which is also called systematic risk, is the chance that investments will lose value because of bigger market factors like economic downturns, global events, or trends in a certain industry.

B. Interest Rate Risk: Changes in interest rates can cause interest rate risk, affecting the value of fixed-income investments like bonds. Bond prices usually go down when interest rates go up and up when they do the opposite, which changes the total return on investment.

C. The risk of inflation: This is when your investments lose value over time because the prices of goods and services tend to go up. If you invest in things that don’t grow faster than inflation, they may lose value over time.

You may not be able to sell an investment fast enough or at a fair price. This is called liquidity risk.

Investing in things that are hard to sell, like real estate or some types of stocks, may come with a higher liquidity risk, making it harder for you to get your money when needed.

The chance that a borrower or issuer of debt assets won’t make interest payments or repay the principal amount is called credit risk.

It is also called default risk. There is a lot of this danger in corporate, municipal, and other debt instruments, especially those with lower credit ratings.

Understanding these types of investment risk is important if you want to make a well-rounded investment plan and maintain your risk tolerance.

How Do I Determine My Risk Tolerance Level?

Determining your risk tolerance level is essential for making informed investment decisions.

Here are some steps to help you assess your risk tolerance:

Self-Reflection:

- Consider your financial goals, investment horizon, and personal circumstances.

- Ask yourself questions like:

- How long do I plan to invest? (Short-term vs. long-term)

- What is my comfort level with market fluctuations?

- Can I handle potential losses without feeling anxious?

Risk Tolerance Questionnaires:

- Many financial institutions and online platforms offer risk tolerance questionnaires.

- These assessments ask about your preferences, financial situation, and investment experience.

- Based on your answers, they provide a risk profile.

Understanding Risk Categories:

- Aggressive: Willing to take substantial risks for potentially higher returns.

- Moderate: Balanced approach, seeking a mix of growth and stability.

- Conservative: Prefers safety and capital preservation over high returns.

Analyze Past Behavior:

- Reflect on how you’ve reacted to market downturns in the past.

- Did you panic and sell, or did you stay calm and hold your investments?

Investment Knowledge:

- Assess your understanding of financial markets, investment products, and risk factors.

- Novices may lean toward conservative choices.

Scenario Testing:

- Imagine different market scenarios (e.g., recession, bull market).

- How would you feel if your portfolio lost value during a downturn?

Consult a Financial Advisor:

- Seeking professional advice can provide valuable insights.

- Advisors can tailor recommendations based on your risk tolerance.

What Are Some Common Investment Mistakes?

Here are some common investment mistakes that investors should be aware of:

Expecting Too Much:

- Having unrealistic return expectations can lead to disappointment.

- It’s essential to maintain a long-term view without reacting emotionally.

No Investment Goals:

- Many investors focus on short-term returns or the latest investment trends instead of considering their long-term goals.

- Define clear investment objectives to stay on track.

Not Diversifying:

- Lack of diversification can expose your portfolio to unnecessary risk.

- Diversify across different asset classes to reduce the impact of any single investment.

Focusing on the Short Term:

- Short-term market fluctuations can lead investors to second-guess their strategy and make careless decisions.

- Maintain a long-term perspective.

Buying High and Selling Low:

- Emotional reactions during market swings often result in poor performance.

- Stick to your investment plan and avoid impulsive actions.

Trading Too Much:

- Excessive trading tends to underperform the market.

- Active traders lagged behind the U.S. stock market by 6.5% annually.

Paying Too Much in Fees:

- High fees can significantly impact overall investment performance over time.

- Be mindful of fees and consider low-cost investment options.

Focusing Too Much on Taxes:

- While tax considerations matter, don’t base investment decisions solely on tax consequences.

- Prioritize overall investment quality.

Not Regularly Reviewing Investments:

- Quarterly or annual portfolio reviews help ensure you’re on track and may require rebalancing.

- Stay informed about your investments.

Misunderstanding Risk:

- Balancing risk is crucial. Too much risk can be uncomfortable, but too little risk may not meet your financial goals.

- Understand your personal risk tolerance.

Not Knowing Your Investment Performance:

- Many investors need to be made aware of their actual returns.

- Regularly review your performance, factoring in fees and inflation.

Reacting to Media Headlines:

- Negative news can trigger fear, but focus on long-term trends.

- Avoid making impulsive decisions based on short-term media noise.

Forgetting About Inflation:

- Historically, inflation averages around 4% annually.

- Over time, inflation erodes the value of money.

Trying to Time the Market:

- Market timing is challenging and often leads to suboptimal results.

- Staying invested yields better returns than attempting to time the market perfectly.

Not Doing Due Diligence:

- Research thoroughly before making investment decisions.

- Verify credentials and background information of financial advisors.

Working With the Wrong Advisor:

- Take the time to find an advisor who aligns with your goals and values.

- A good advisor can make a significant difference in your investment journey.

Strategies for Managing Risk Tolerance

To effectively manage risk tolerance, you need to use a variety of tactics to minimize possible downsides while maximizing returns.

A. Diversification: To spread risk and lessen the effect of a single investment’s poor performance, you should spread your investments across a variety of asset classes, industries, and geographic areas.

You might be able to limit your loses when the market goes down if you don’t put all your eggs in one basket.

B. Asset Allocation: This is the process of choosing the best mix of asset classes, like stocks, bonds, and cash, based on your risk tolerance, financial goals, and time horizon.

A well-balanced asset allocation can help you get the results you want while letting you control the level of risk that you are comfortable with.

C. Dollar-Cost Averaging: With dollar-cost averaging, you spend the same amount of money on a regular basis, even if the market goes up and down.

This plan can help lessen the effect of market volatility by getting more shares when prices are low and fewer shares when prices are high. Over time, this will lower the average cost per share.

D. Rebalancing: To maintain your goal asset allocation, you need to review and change your investment portfolio regularly. This is an important part of managing your risk tolerance.

To get your risk-to-reward balance back to where you want it to be, rebalancing means selling assets that have become too heavy and putting the money back into assets that are too light.

By using these tactics when you invest, you can control how much risk you are willing to take and feel confident in the financial markets.

Psychological Aspects of Risk Tolerance

To be a good investor, you need to understand how people think about risk tolerance.

Here are some important things to think about:

A. Overcoming Greed and Fear: Greed and fear are strong feelings that can greatly affect investment choices. When the market goes down, investors may sell their investments out of fear, while investors seeking high returns may be too greedy and take too many risks.

Getting past these feelings takes self-control and an investment strategy based on long-term goals instead of short-term changes.

B. Emotional Biases in Making Choices: Emotional biases, like loss aversion or confirmation bias, can make it hard to make good choices, like which investments to make.

Investors can make better choices that fit their risk tolerance by being aware of these biases and taking steps to lessen their effects through thorough research, diversification, and disciplined investment strategies.

C. Building Resilience: To handle the inevitably ups and downs of the market, you need to build resilience. To do this, you need to learn to accept uncertainty and see failures as chances to learn and grow instead of reasons to freak out.

Key ways to become more resilient in the face of market volatility are to develop patience, keep your eye on long-term goals, and keep your portfolio diverse.

By thinking about these mental aspects of risk tolerance, investors can better understand how the financial markets work and make choices that fit their investment goals and level of psychological comfort.

Ethical Considerations in Risk Tolerance

Ethical concerns have become more important in business decisions in the past few years.

In this case, two important things are:

A. Socially Responsible Investing (SRI) means picking investments based on factors like ethics, society, and the earth.

If SRI is vital to investors, they might stay away from companies that work in controversial fields like tobacco, guns, or fossil fuels.

Instead, they might choose companies that benefit society, such as those that use green energy or use fair labor practices.

B. Environmental, Social, and Governance (ESG) Factors: ESG factors are a set of standards used to judge how sustainable and moral a business is.

When investors figure out how much risk they are willing to take, they might look for companies that have strong environmental programs, commitments to social responsibility, and strong corporate governance systems.

By making investments that are in line with their morals, investors can not only lower their risk but also help make the world a better place.

When investors think about these moral issues and traditional risk factors, they can get a more complete picture of their investments, which helps them make portfolios that fit their personal values and financial goals.

Regulation and Compliance in Managing Risk Tolerance

To find your way around the world of investment risk tolerance, you have to follow many rules and regulations meant to protect clients.

A. Regulatory Frameworks: In the US, the Securities and Exchange Commission (SEC) and other regulatory bodies make rules and laws about how investment firms and financial markets should work.

These models set rules for openness, honesty, and fair play to protect investor trust and market integrity.

B. Compliance Standards: Investment firms and professionals must follow strict compliance standards to reduce risks and protect investor interests. Compliance measures include conducting research, assessing risks, and following best business practices.

C. Investor Protection Laws: These laws protect investors from dishonest business practices and wrongdoing in the financial sector.

By setting up ways for investors to get their money back if something goes wrong, these rules ensure that investors have options.

Investment professionals must follow compliance frameworks, compliance standards, and investor protection laws to handle risk tolerance in a way that is accountable, open, and based on trust.

Must Read This: Unlocking Wealth: Dive into the 31 Best Investment Books for Financial Mastery!

Conclusion

Understanding and controlling your business risk tolerance is important for making money in today’s complicated market.

Throughout this detailed guide, we’ve discussed investment risk tolerance, its effects, and how to measure and manage it effectively.

We’ve talked about a lot of different topics to help investors make smart choices that are in line with their risk tolerance levels.

These topics range from common investment mistakes to psychological biases and ethical issues. We’ve also talked about how important it is to follow the rules in order to protect investors’ interests and keep the market honest.

By using the information in this guide, investors can confidently and resolutely navigate the constantly changing world of investments, knowing exactly how much risk they are willing to take.

Remember that investing is a process. If you stay aware and flexible, you can stay on track with your financial goals while navigating the ups and downs of the market.

Disclaimer: The information in this guide comes from my research and investment experience. I am not a financial advisor. Even though I tried to give you correct and up-to-date information, you should still do your own research before investing.

Some risks come with investing, and each person’s situation may differ. Because of this, people who want to use any of the investment strategies in this guide should talk to a qualified financial advisor or do a lot of study first.

Please note that I am not responsible for the information’s accuracy, completeness, or dependability or any financial choices based on this guide.

I would love to keep sharing this kind of informative content in the future, so please subscribe to our email newsletter, and if you have to add your thoughts regarding investment, please put your words in the comment section below.

Frequently Asked Questions

What is the significance of understanding risk tolerance

Understanding risk tolerance is significant because it helps investors make informed decisions aligned with their financial goals and psychological comfort levels. By knowing their risk tolerance, investors can choose appropriate investment strategies, manage their portfolios effectively, and confidently withstand market fluctuations.

Can risk tolerance change over time?

Yes, risk tolerance can change over time due to various factors, such as financial circumstances, life events, and shifts in personal priorities or attitudes toward risk.

What are the consequences of ignoring risk tolerance?

Ignoring risk tolerance can lead to inappropriate investment decisions, increased susceptibility to emotional biases, and potential financial losses.

How can I mitigate risks associated with my risk tolerance level?

You can mitigate risks associated with your risk tolerance level by diversifying your investment portfolio, adhering to a disciplined investment strategy, and regularly reassessing your risk tolerance in light of changing circumstances.