Are you excited to explore the best investment books?

In today’s ever-changing financial world, proper knowledge can make all the difference in achieving financial security and prosperity.

Understanding the importance of investment knowledge goes beyond just making money; it’s about empowering yourself to take control of your financial future.

Whether you’re a seasoned investor or just starting on your financial journey, immersing yourself in the world of investment books offers a treasure trove of insights and strategies to help you navigate the complex landscape of finance.

In this article, I will not give you financial advice or investment tricks, but I have also read the best investment books that have helped me understand how and where to make investments.

In this post, I will share the best investment books you should read before planning an investment to get clarification and a better understanding.

Join me on an exciting exploration as we uncover the top 31 investment books, each offering its blend of practical advice, timeless wisdom, and real-world success stories.

Let’s embark on this journey towards financial mastery and unlock the keys to wealth creation!

Foundational Concepts in Investing

Understanding the basics of investing is like laying the groundwork for building your financial future.

When we talk about investing, we’re essentially talking about putting our money into things with the hope of making more money over time.

But it’s important to know that with the potential for higher returns comes the possibility of facing risks along the way. These risks and returns go hand in hand.

Now, let’s talk about the things you can invest in. There are different types, like stocks, which are a piece of a company you can own; bonds, which are like loans you give to governments or companies; real estate, which means owning property; and commodities, like gold or oil.

And here’s something interesting to consider: the value of money changes over time, which is called the Time Value of Money.

A dollar today might be worth more than a dollar in the future because of inflation or missed opportunities.

Understanding these simple yet crucial concepts is like having a map for your financial journey, guiding you toward making intelligent investment decisions.

Essential Investment Strategies

When it comes to investing, there are a few key strategies to consider, each with its approach.

Value investing is about finding bargains in the market, like buying something on sale.

Growth investing looks for companies with significant growth potential, even if they cost more upfront.

Income investing is all about getting a steady stream of money from your investments, like getting rent from a property you own.

Index funds and ETFs are like buying a little of everything in the market, so you don’t have to pick individual stocks.

Diversification means spreading your money across different types of investments, so if one goes down, the others can help balance it out.

And lastly, market timing is trying to predict when to buy and sell based on how the market is doing.

Each strategy has pros and cons, but you can make smarter choices with your money by understanding them. And better consult with a financial advisor who can help you further!

Best Investment Books for Beginners

1. The Little Book That Beats the Market

“The Little Book That Beats the Market” by Joel Greenblatt is a must-read for investment beginners. Written by renowned investor Joel Greenblatt, it introduces the “magic formula” for investing, focusing on identifying undervalued companies with solid earnings potential.

With simple explanations and practical examples, Greenblatt empowers readers to navigate the stock market confidently. This book offers valuable insights and actionable advice to kickstart your investment journey effectively.

2. Business Adventures

“Business Adventures” by John Brooks is a timeless investment classic, originally published in 1969. This book offers valuable insights into business and investing through captivating storytelling and astute analysis.

It covers various corporate and financial events, providing essential market dynamics and entrepreneurship lessons.

Renowned investor Warren Buffett has praised it as a must-read for investors of all levels, making it an excellent choice for beginners seeking to understand the fundamentals of investing.

3. Fooled by Randomness: The Hidden Role of Chance in Life and the Markets

For beginners venturing into investments, “Fooled by Randomness: The Hidden Role of Chance in Life and the Markets” by Nassim Nicholas Taleb is essential.

In this book, Taleb, a former Wall Street trader, explores the impact of randomness on financial markets and life. Through engaging stories and insights, he emphasizes the importance of understanding uncertainty and questioning conventional wisdom in investment decisions.

This concise read offers valuable lessons on risk and probability, making it an indispensable resource for those starting their investment journey.

4. Rich Dad’s Guide To Investing

For beginners venturing into investing, “Rich Dad’s Guide To Investing” by Robert T. Kiyosaki is a must-read.

With straightforward advice and anecdotal wisdom, Kiyosaki simplifies complex investment concepts, laying a solid foundation for financial success.

This book not only teaches crucial investment strategies but also cultivates a mindset conducive to wealth building. It’s an essential tool for anyone starting their investment journey.

5. The Book on Rental Property Investing

For beginners diving into real estate investment, “The Book on Rental Property Investing” by Brandon Turner is a gem. Brandon, a seasoned investor, and co-host of the “BiggerPockets” podcast, delivers practical tips on property acquisition, management, and maximizing profits.

With clear advice on analyzing properties, financing, and handling tenants, this book is an essential starting point for those venturing into the world of real estate investment.

6. One Up On Wall Street: How To Use What You Already Know To Make Money In The Market

“For beginners venturing into investing, ‘One Up On Wall Street: How To Use What You Already Know To Make Money In The Market’ by Peter Lynch is a must-read.

Authored by the renowned investor Peter Lynch, this book simplifies complex financial concepts, offering practical advice and real-world examples.

Lynch emphasizes leveraging everyday observations to uncover promising investment opportunities, making it an ideal starting point for those new to investing.

With clear insights and actionable strategies, ‘One Up On Wall Street’ equips beginners with the knowledge and confidence to navigate the markets effectively.”

7. The Millionaire Next Door

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko is a must-read for novice investors. This book delves into the habits and lifestyles of America’s wealthy, offering valuable insights into wealth accumulation and debunking common misconceptions.

With practical advice and engaging anecdotes, it serves as an essential guide for beginners looking to kickstart their journey toward financial success.

8. I Will Teach You To Be Rich

“I Will Teach You To Be Rich” by Ramit Sethi is a must-read for beginners entering the investment realm. Sethi, a leading personal finance expert, offers clear, practical advice on managing money, investing intelligently, and laying the groundwork for long-term wealth.

Through straightforward strategies and relatable examples, Sethi empowers readers to take charge of their financial future confidently and easily.

9. A Beginner’s Guide To The Stock Market: Everything You Need To Start Making Money Today

“A Beginner’s Guide To The Stock Market: Everything You Need To Start Making Money Today” by Matthew R. Kratter is a must-read for novice investors. Kratter simplifies complex stock market concepts, such as stock selection and risk management, making them easy to grasp.

With clear explanations and practical advice, this book equips beginners with the knowledge and confidence to kickstart their investment journey and build wealth effectively.

10. The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success

“The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success” by William N. Thorndike is a must-read for beginners venturing into investment.

Thorndike analyzes eight exceptional CEOs who succeeded remarkably by defying conventional business strategies. Readers gain insights into rational capital allocation and long-term value creation through their stories, making this book an essential guide for those starting their investment journey.

11. Principles

“Principles: Life and Work” by Ray Dalio is a must-read for investment novices. Dalio, the founder of Bridgewater Associates, breaks down complex financial concepts into easily digestible principles.

This book provides valuable insights on market cycles, risk management, and fostering a growth mindset, making it an essential guide for beginners venturing into the world of investments.

12. Irrational Exuberance

“Irrational Exuberance” by Nobel laureate economist Robert J. Shiller is a must-read for novice investors. This concise yet insightful book delves into market psychology, shedding light on the forces driving market fluctuations.

Through historical analysis, Shiller provides valuable insights into market bubbles and crashes, empowering readers to make informed investment decisions.

It’s an essential primer for anyone looking to understand the basics of investing and confidently navigate the markets.

13. You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits

“For beginners dipping their toes into investment waters, Joel Greenblatt’s ‘You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits’ is a must-read. Greenblatt, a seasoned investor and hedge fund manager, offers straightforward insights and practical advice to navigate the complexities of the stock market.

Through engaging stories and clear language, he reveals unconventional strategies to spot lucrative investment opportunities often missed by others.

This concise guide equips newcomers with essential tools and knowledge to kickstart their investment journey confidently.”

14. Beating the Street

“Beating the Street” by Peter Lynch is a must-read for beginner investors. Lynch, a highly successful mutual fund manager, offers clear and actionable advice on navigating the investing world.

Through relatable stories and practical tips, Lynch emphasizes the importance of research, patience, and understanding the companies you invest in. This book provides a solid foundation for those new to investing, making it an essential addition to any beginner’s reading list.

15. The Bogleheads’ Guide to Investing

“The Bogleheads’ Guide to Investing” by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf is a must-read for investment beginners.

Authored by experts in the field, this book simplifies complex concepts and advocates for low-cost, diversified index fund investing. It’s a practical guide that equips beginners with essential knowledge to navigate investing confidently, focusing on minimizing fees and risks.

16. Market Wizards

“Market Wizards” by Jack D. Schwager is a must-read for beginner investors. Through interviews with successful traders, Schwager provides valuable insights into various trading strategies and the psychology behind them.

This book offers practical advice and wisdom, making it an essential resource for anyone looking into investing and financial markets.

17. The Dhandho Investor

“The Dhandho Investor” by Mohnish Pabrai is a must-read for beginners venturing into investing. Pabrai, a successful investor, shares a simple yet powerful framework inspired by Warren Buffett’s principles and Indian entrepreneurial wisdom.

With practical examples, he emphasizes low-risk, high-reward strategies, making it an ideal starting point for those who navigate the markets wisely and build long-term wealth.

18. The Black Swan: The Impact of the Highly Improbable

For beginners diving into an investment, “The Black Swan: The Impact of the Highly Improbable” by Nassim Nicholas Taleb is a must-read. Taleb, a former trader, delves into the concept of black swan events—unexpected occurrences with significant consequences—in financial markets.

Through compelling anecdotes, he underscores the importance of understanding risk and uncertainty, offering invaluable insights for those new to investing. This book equips beginners with the essential knowledge to navigate market unpredictability and develop a solid investment approach.

19. Antifragile

“For beginners dipping their toes into investing, Nassim Nicholas Taleb’s ‘Antifragile’ is a must-read. Taleb, an expert in risk and uncertainty, introduces the concept of antifragility—how systems can benefit from chaos.

This book teaches readers to survive and thrive in volatile markets through practical examples and philosophical insights. ‘Antifragile’ offers essential wisdom for those starting their investment journey.”

20. The Simple Path To Wealth

“For beginners, ‘The Simple Path To Wealth’ by J.L. Collins is a must-read. Collins breaks down complex financial ideas into easy-to-understand concepts, advocating for low-cost index fund investing and long-term strategies.

This book is perfect for those starting their investment journey, offering practical advice for building wealth and achieving financial independence.”

21. The Bond King

For beginners venturing into investing, “The Bond King” by Mary Childs is a must-read. Authored by financial journalist Mary Childs, this book introduces the bond market clearly. Childs simplifies complex concepts, making it perfect for newcomers.

With practical advice and real-life examples, “The Bond King” sets readers on the path to understanding fixed-income securities and strategies for financial success.

22. The Intelligent Investor

“The Intelligent Investor” by Benjamin Graham is a must-read for beginners diving into investing. Written by the esteemed economist and investor, Graham breaks down the fundamentals of value investing, emphasizing research, rational decision-making, and long-term strategies.

With clear language and timeless insights, this book equips readers with the essential knowledge and mindset needed to navigate the complexities of the market confidently.

23. Patient Capital

“For beginners venturing into the world of investing, “Patient Capital: The Long-Term Value Investor’s Guide” by Victoria Ivashina and Josh Lerner is an invaluable resource.

This book offers practical insights into long-term investment strategies, emphasizing the importance of patience for financial success.

With straightforward advice and real-world examples, Ivashina and Lerner equip newcomers with the tools and mindset needed to navigate the complexities of investing and achieve lasting wealth.”

24. The Billionaire’s Apprentice

“The Billionaire’s Apprentice” by Anita Raghavan is a must-read for beginners diving into investing.

Through the gripping tale of hedge fund manager Raj Rajaratnam and his protégé Rajat Gupta, Raghavan offers valuable insights into Wall Street’s inner workings and the ethical challenges investors may face.

This concise yet captivating narrative serves as an excellent primer, highlighting the importance of integrity in financial success.

25. The Psychology of Money

For beginners dipping their toes into investing, “The Psychology of Money” by Morgan Housel is essential reading. Housel delves into how human behavior influences financial decisions, offering practical insights and anecdotes.

This book provides a valuable foundation for understanding the psychological aspects of money management, making it a must-read for those starting their investment journey.

26. The Only Investment Guide You’ll Ever Need

“The Only Investment Guide You’ll Ever Need” by Andrew Tobias is a must-read for beginners entering the investment arena. With clear explanations and practical advice, Tobias covers essential topics like stocks, bonds, mutual funds, and retirement planning.

His witty writing style makes complex concepts easy to grasp, empowering readers to confidently navigate their financial journey toward wealth-building.

27. Rich Dad Poor Dad

“Rich Dad Poor Dad” by Robert T. Kiyosaki is a must-read for investment beginners. Kiyosaki contrasts the financial philosophies of his biological father (the “poor dad”) and the father of his friend (the “rich dad”), offering practical insights on money management and investing.

This book challenges traditional notions about wealth and provides essential guidance for those looking to kickstart their journey toward financial independence.

28. The Little Book of Common Sense Investing

For beginners venturing into investing, “The Little Book of Common Sense Investing” by John C. Bogle is a must-read. Bogle, the founder of Vanguard Group, advocates for index investing’s simplicity and effectiveness.

He emphasizes keeping costs low and staying steady through market ups and downs. With its accessible language and timeless advice, this book is an essential guide for those starting their journey toward financial mastery.

29. A Random Walk Down Wall Street

For beginners venturing into investing, “A Random Walk Down Wall Street” by Burton G. Malkiel is a must-read. Malkiel breaks down complex concepts into easy-to-understand insights, advocating for a passive investment approach and emphasizing the significance of diversification and long-term thinking.

This classic offers practical wisdom to help newcomers navigate the financial markets effectively.

30. The Essays of Warren Buffett

“The Essays of Warren Buffett,” written by the legendary investor, offers beginners invaluable insights into the investment world.

This collection of Buffett’s letters to Berkshire Hathaway shareholders distills his investment philosophy and strategies into accessible lessons, making it an essential starting point for anyone venturing into finance.

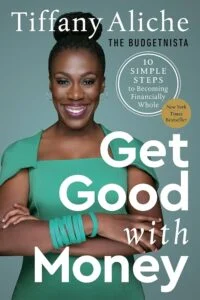

31. Get Good With Money

“Get Good With Money” by Tiffany Aliche is a go-to resource for novice investors. Aliche, also known as the “Budgetnista,” simplifies financial concepts, offering practical advice to kickstart your journey toward financial independence.

Through relatable stories and actionable tips, this book equips beginners with essential skills to manage debt, build wealth, and develop a solid financial foundation.

If you’re starting your investment journey, “Get Good With Money” is a must-read for its straightforward guidance and empowering approach.

The Role of Financial Advisors and Investment Professionals

When diving into the world of investments, having a financial advisor or investment professional by your side can make a big difference.

It’s like having a guide on a journey – you want someone who knows the terrain well and can help you navigate safely.

Choosing the right advisor means finding someone you trust and who understands your goals and needs. Understanding how they get paid is essential so you know what to expect.

You might decide to manage your investments on your own, which can be empowering and save you money, but it also means you’ll need to do more research and make decisions independently.

On the other hand, hiring a professional means, you’ll have someone with expertise to guide you, which can be especially helpful if your financial situation is complex or you need more time to manage your investments. Ultimately, it’s about finding the right approach for you and your financial goals.

Conclusion

In wrapping up our exploration of these best investment books, it’s clear that they’re like treasure chests full of wisdom for building wealth.

We’ve learned much about making wise financial decisions and growing our money wisely. From the importance of spreading out our investments to the tricks of the trade, like finding undervalued stocks, these books have given us a roadmap to follow.

But remember, just knowing isn’t enough; we’ve got to put these ideas into action. Keep learning, stay patient, and adapt as you go along.

With dedication and a little bit of know-how, you’ve got everything you need to set yourself up for financial success.

If you have found this article helpful, share it with others and subscribe to our email newsletter to keep receiving this kind of informative content directly in your inbox.

Frequently Asked Questions

How much money do I need to start investing?

The money needed to start investing varies depending on the investment vehicle and your financial goals. However, many online brokerages now offer opportunities to start investing with as little as $100 or even less. It’s essential to assess your financial situation, set clear investment goals, and start with an amount you’re comfortable with.

What are the risks associated with investing?

The risks associated with investing include market volatility, potential loss of principal, inflation risk, interest rate risk, currency risk (for international investments), liquidity risk, and specific risks related to the type of investment (e.g., business risk for stocks, default risk for bonds).

How do I choose the best investment strategy for my goals?

To choose the best investment strategy for your goals, assess your risk tolerance, time horizon, and financial objectives. Consider diversification, research different investment options, and consult with a financial advisor for personalized advice tailored to your needs.

Twitter

Twitter Facebook

Facebook