Nvidia Corporation, the powerhouse in the technology sector, has been making headlines with its exceptional Nvidia stock performance. Following a 10-for-1 stock split, Nvidia’s stock continues to soar, capturing the attention of investors and analysts alike. This article delves into the factors driving Nvidia’s remarkable rise, the implications of its stock split, and why experts believe the rally is far from over.

The Story Behind Nvidia stock Meteoric Rise

Evolution of Nvidia

Founded in 1993, Nvidia has grown from a graphics card manufacturer to a leader in artificial intelligence (AI), gaming, and data centers. Its innovative products, such as the GeForce RTX series, have revolutionized gaming, while its AI capabilities have found applications in diverse fields, from healthcare to autonomous vehicles.

Key Milestones

- Graphics Revolution: The launch of the GeForce series in 1999 revolutionized gaming graphics, setting a new industry standard.

- AI and Data Centers: Nvidia’s foray into AI with its CUDA platform and data center GPUs has positioned it at the forefront of the AI revolution.

- Stock Market Performance: Nvidia’s stock has seen exponential growth, reflecting its successful expansion into new markets and continuous innovation.

Stock Split Explained

In July 2021, Nvidia announced a 10-for-1 stock split, which came into effect on July 20, 2021. This move made Nvidia’s shares more accessible to a broader range of investors, increasing liquidity and market participation. The stock split was seen as a strategic move to attract retail investors and boost overall market interest in Nvidia’s shares.

Factors Driving Nvidia’s Stock Surge

Dominance in Gaming and AI

Nvidia’s dominance in the gaming industry is unparalleled. The GeForce RTX series, with its advanced ray-tracing capabilities, has set new benchmarks for gaming graphics. Simultaneously, Nvidia’s AI technology has been pivotal in various sectors, including healthcare, automotive, and finance. The company’s GPUs power AI models used in deep learning and neural networks, driving demand across multiple industries.

Strategic Acquisitions and Partnerships

Nvidia’s strategic acquisitions, such as the purchase of Mellanox Technologies in 2019, have bolstered its capabilities in high-performance computing and networking. Partnerships with leading tech firms and participation in key industry collaborations have further strengthened Nvidia’s market position.

Financial Performance

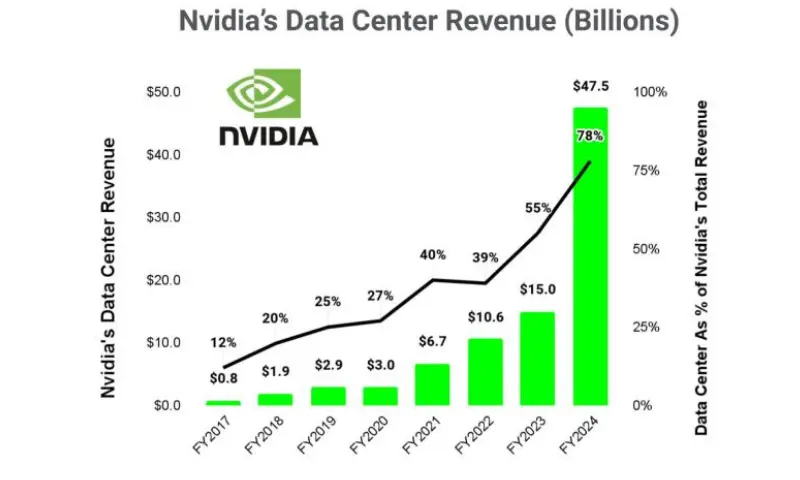

Nvidia’s financial performance has been stellar, with consistent revenue growth and robust profit margins. The company’s Q1 2024 earnings report showcased significant revenue increases, driven by strong demand for its gaming and data center products. This financial robustness has instilled confidence in investors, contributing to the stock’s upward trajectory.

Expansion into New Markets

Nvidia’s expansion into new markets, such as automotive and the Internet of Things (IoT), has opened new revenue streams. Its Drive platform for autonomous vehicles and Jetson platform for AI at the edge are examples of how Nvidia is leveraging its technology to enter and dominate emerging markets.

Analysts’ Perspectives: Why the Rally is Far from Over

Bullish Outlook

Many analysts have a bullish outlook on Nvidia’s future. They cite the company’s strong market position, innovative product pipeline, and ability to capitalize on emerging trends in AI and gaming as key reasons for their optimism.

Valuation Metrics

Despite its high valuation, analysts believe Nvidia’s growth potential justifies its premium price. Key valuation metrics, such as price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio, are often compared with industry peers to highlight Nvidia’s competitive edge.

Technological Advancements

Nvidia’s continuous investment in research and development (R&D) ensures it remains at the cutting edge of technology. Innovations in AI, machine learning, and graphics processing are expected to drive future growth, maintaining Nvidia’s leadership in the tech industry.

Potential Challenges and Risks

Market Competition

Nvidia faces stiff competition from other tech giants, such as AMD and Intel. These competitors are also investing heavily in AI and gaming, posing potential challenges to Nvidia’s market dominance.

Regulatory Scrutiny

As Nvidia expands its influence, it faces increased regulatory scrutiny. Antitrust investigations and trade restrictions could pose risks to its operations and growth prospects.

Supply Chain Issues

Global supply chain disruptions, particularly in semiconductor manufacturing, could impact Nvidia’s ability to meet market demand. Ensuring a robust supply chain is crucial for sustaining its growth momentum.

Nvidia’s stock has been on a meteoric rise, driven by its dominance in gaming and AI, strategic acquisitions, strong financial performance, and expansion into new markets. Analysts remain optimistic about its future, citing technological advancements and growth potential. However, potential challenges, such as market competition, regulatory scrutiny, and supply chain issues, need to be navigated carefully.

In the dynamic world of technology, Nvidia continues to set new benchmarks, captivating investors and industry watchers alike. As the company forges ahead, the consensus is clear: Nvidia’s stock has room to run, and the rally is far from over.

Final Thoughts

Investors should keep an eye on Nvidia’s strategic moves and market trends. While the stock’s high valuation may seem daunting, its growth potential and market leadership make it a compelling choice for long-term investment. As always, thorough research and a balanced portfolio approach are recommended for navigating the exciting yet volatile tech sector.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial professional before making any investment decisions.