How to Get a Startup Business Loan with No Money might seem impossible, but in 2024, it’s more feasible than ever.

With the right information and plan, you can get a loan to start a business even if you don’t have any money to put down.

This complete guide will walk you through the whole process, from learning about the different kinds of loans out there to making an application that stands out.

This post will give you the information and tools you need to make your business dream come true, whether you’re looking into traditional loans, government grants, microfinance choices, or crowdfunding platforms.

Prepare to dive into the world of startup financing and learn how to get the money your business needs to get off the ground.

What are Startup Business Loans?

Startup business loans are financing that help new companies get the money they need to start up and grow.

In 2024, these loans are designed to help entrepreneurs who might not have a lot of money to spend at first.

Startup business loans, unlike traditional loans, often look at more than just credit history.

For example, they may look at business plans, growth prospects, and new ideas.

They come in many forms, such as microfinance choices, government-backed loans, and crowdfunding platforms. Each has its own benefits and requirements that are specific to the needs of a business.

Understanding these types of loans and their requirements is essential for managing the financial world and getting the money you need to start your business.

Importance of Funding for Startups

In 2024, funding is very important for startups to be successful and last. Entrepreneurs can cover initial costs like product creation, marketing, and operational costs by getting enough funding.

Funding helps companies do more than just stay alive; it also helps them grow, come up with new ideas, and break into competitive markets.

It protects against changes in the economy and makes it easier to make smart investments that can speed up growth and profits.

Having access to funding also boosts a startup’s credibility in the eyes of possible partners, customers, and investors.

This sets them up for long-term success and survival in today’s fast-paced business world.

How to Get a Startup Business Loan with No Money

Securing a startup business loan without initial capital in 2024 requires careful planning and strategy.

Here’s a detailed approach to navigate the process effectively:

- Check the Eligibility Requirements: Begin by researching and comparing eligibility criteria across multiple business lenders. Each lender may have specific requirements related to credit history, revenue projections, business plan details, and industry focus. Understanding these prerequisites helps you target lenders whose criteria align closely with your business profile, increasing your chances of approval.

- Decide on Collateral Assets: While seeking a loan without money down, consider which assets—such as equipment, inventory, or even personal property—you could offer as collateral. Collateral provides security to lenders, reducing their risk and potentially increasing your loan approval chances. Evaluate your assets carefully and be prepared to discuss their value and feasibility as collateral during lender negotiations.

- Determine Loan Repayment Capacity: Before applying for a startup loan, conduct a thorough assessment of your financial situation. Calculate your business’s projected cash flow and revenue streams to estimate how much loan you can comfortably repay within the stipulated terms. Lenders often evaluate repayment capacity based on current and projected business performance, so having realistic financial projections is crucial.

- Review Loan Terms and Fine Print: Read through the loan agreement meticulously. Pay attention to interest rates, repayment schedules, fees, and any additional terms or conditions that may impact your financial obligations. Understanding the terms ensures you’re fully aware of the cost of borrowing and can make informed decisions about whether the loan aligns with your business’s financial goals.

- Prepare for Personal Guarantee: Most startup loans, especially those without upfront capital, typically require a personal guarantee. This commitment holds you personally liable for loan repayment if your business fails to meet its obligations. Understand the implications of signing a personal guarantee and consider seeking legal advice to clarify any concerns before proceeding.

- Evaluate Benefits and Risks: Assess the advantages and potential drawbacks of obtaining a startup business loan. While funding can fuel growth and expansion, it also entails financial obligations and risks, including the impact on your credit rating and personal finances in case of business downturns. Balance the benefits of immediate capital infusion with the long-term financial implications for your business.

- Prepare a Detailed Business Plan: A comprehensive business plan is essential when applying for a startup loan. Outline your business’s mission, market analysis, competitive landscape, revenue projections, and operational strategies. Emphasize how the loan will facilitate business growth and profitability. A well-structured business plan not only demonstrates your commitment and vision but also provides lenders with confidence in your ability to manage funds responsibly.

By following these steps diligently, entrepreneurs can navigate the complexities of securing a startup business loan in 2024, even without upfront capital. Each aspect—from eligibility checks to business planning—plays a crucial role in positioning your startup for financial success and sustainable growth.

Understanding No Money Startup Loans

In 2024, navigating the landscape of startup loans without initial capital requires a clear understanding of available options and eligibility criteria:

Definition and Eligibility Criteria: No money startup loans are designed to assist entrepreneurs who lack significant initial funds to invest in their ventures.

Unlike traditional loans that may require substantial collateral or down payments, these loans often focus on alternative factors such as business viability, innovative ideas, and growth potential.

Eligibility criteria typically include a robust business plan, proof of concept, and sometimes personal credit history.

Lenders assess these factors to mitigate risk while supporting promising startups in their early stages of development.

Types of Startup Loans Available: Several types of no money startup loans cater to different business needs and stages:

- Government-backed Loans: Offered through programs like the Small Business Administration (SBA), these loans provide favorable terms and lower interest rates. They require thorough documentation and compliance with government regulations but can be an excellent option for qualifying startups.

- Microfinance Options: Microloans from community-based lenders or nonprofit organizations provide smaller amounts of funding tailored to startups with limited financial history. These loans often come with flexible terms and supportive resources for business development.

- Crowdfunding Platforms: Crowdfunding leverages online platforms to raise capital from a large pool of investors or supporters. It allows startups to showcase their business idea, attract backers, and receive funding without traditional loan obligations.

- Venture Capital and Angel Investors: High-growth startups may seek funding from venture capitalists (VCs) or angel investors who provide capital in exchange for equity. This funding avenue requires pitching a compelling business case and aligning with investor expectations for growth and profitability.

- Collateral-Free Loans and Lines of Credit: Some lenders offer unsecured loans or lines of credit based on the strength of the business plan and revenue projections. These options can be accessible for startups that demonstrate strong potential but lack tangible collateral.

Preparing for the Loan Application Process

Successfully obtaining a startup business loan without upfront capital in 2024 requires careful preparation and attention to key aspects of your business:

Assessing Financial Readiness: Before applying for a loan, assess your startup’s financial readiness. Review your current financial situation, including cash flow projections, revenue forecasts, and expenses.

Lenders will scrutinize these aspects to gauge your ability to repay the loan.

Strengthen your financial position by improving cash flow management, reducing unnecessary expenses, and maintaining transparent financial records.

Demonstrating financial stability and responsible money management enhances your credibility as a loan applicant.

Building a Strong Business Plan: A robust business plan is a cornerstone of any successful loan application.

Outline your business goals, target market, competitive analysis, and unique value proposition. Include detailed financial projections, such as income statements, balance sheets, and cash flow forecasts, to illustrate your startup’s growth potential and profitability.

Emphasize how the loan will support specific business objectives, such as product development, marketing initiatives, or expansion plans.

A well-crafted business plan not only showcases your vision and strategic direction but also reassures lenders of your commitment to achieving sustainable business success.

By diligently assessing your financial readiness and crafting a comprehensive business plan, you can position your startup favorably during the loan application process.

These steps not only enhance your chances of securing funding but also demonstrate your preparedness and dedication to building a thriving business in 2024 and beyond.

Exploring Government Grants and Programs

Government grants and programs provide valuable funding opportunities for startups in 2024, particularly those aiming to launch without initial capital:

Overview of Available Grants: Government agencies at the federal, state, and local levels offer grants designed to support small businesses and startups.

These grants may target specific industries, innovation projects, or economic development initiatives. Grants can range from seed funding for early-stage ventures to substantial awards for research and development.

Each grant program has distinct eligibility criteria, funding objectives, and application procedures, so it’s essential to research available options thoroughly.

How to Qualify and Apply: Qualifying for government grants typically involves meeting specific criteria related to business type, location, industry focus, and intended use of funds. Startups must demonstrate innovation, economic impact, and alignment with grant program priorities.

The application process often requires submitting a detailed proposal outlining your business idea, project objectives, budgetary needs, and expected outcomes.

Additionally, prepare to provide supporting documentation such as financial statements, business plans, and relevant licenses or certifications.

Be mindful of application deadlines and comply with all requirements to maximize your chances of securing government grant funding for your startup in 2024.

Utilizing Microfinance and Community Development Loans

Microfinance options and community development loans offer accessible funding avenues for startups in 2024, especially those without initial capital:

Introduction to Microfinance Options: Microfinance institutions (MFIs) and community lenders provide small-scale loans tailored to the needs of startups and entrepreneurs.

These loans typically have lower borrowing thresholds than traditional financial institutions, making them accessible to individuals with limited financial history or collateral.

Microfinance options may also include financial literacy programs, mentorship, and networking opportunities to support business growth and sustainability from the outset.

Benefits and Considerations: One of the primary benefits of microfinance and community development loans is their inclusivity, offering funding to underserved communities and businesses that may not qualify for conventional loans.

These loans often come with flexible repayment terms, allowing startups to manage cash flow during early stages of operation. However, borrowers should consider potential higher interest rates and smaller loan amounts compared to traditional financing options.

Additionally, assess the lender’s reputation, terms, and support services to ensure alignment with your startup’s financial goals and long-term sustainability.

By leveraging microfinance and community development loans effectively, startups can access critical funding while contributing to local economic development and entrepreneurial empowerment in 2024.

Crowdfunding as a Funding Option

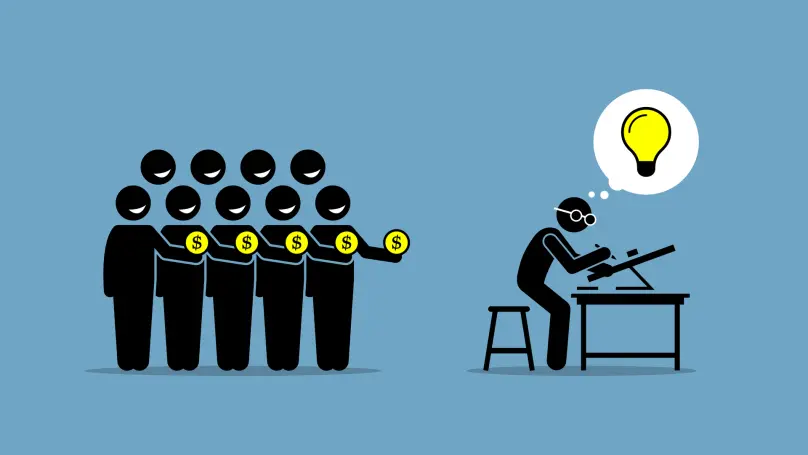

Crowdfunding has emerged as a popular funding option for startups in 2024, offering a platform-driven approach to raise capital without traditional loans:

Platforms and Strategies for Success: Crowdfunding platforms like Kickstarter, Indiegogo, and GoFundMe enable entrepreneurs to showcase their business ideas and attract financial support from a diverse audience of backers.

Choose a platform aligned with your business niche and target audience. Successful crowdfunding campaigns often leverage compelling storytelling, multimedia content (such as videos and images), and incentives like pre-orders or exclusive rewards to incentivize contributions.

Engage with backers actively through updates and social media outreach to maintain momentum throughout the campaign period.

Tips for Launching a Crowdfunding Campaign:

- Start by setting clear goals for funding amount and timeline, backed by realistic financial projections and a detailed budget breakdown.

- Craft a compelling campaign narrative that highlights your business’s unique value proposition, impact, and market potential.

- Invest in high-quality visuals and persuasive content that resonate with your audience and convey credibility.

- Leverage your network, including friends, family, and professional contacts, to kickstart initial contributions and build social proof.

- Engage with supporters consistently, respond to inquiries promptly, and express gratitude for their contributions to foster a community around your startup’s mission.

By executing a well-planned crowdfunding campaign, startups can access capital, validate market demand, and cultivate a loyal customer base in 2024.

Also Read This Related Article: Entrepreneurship Explained: Transform Your Ideas into Success

Venture Capital and Angel Investors

Venture capital (VC) and angel investors represent significant funding opportunities for high-growth startups in 2024, offering capital in exchange for equity stakes:

Understanding Investor Expectations: Venture capitalists and angel investors seek startups with high growth potential and scalability.

They often invest larger sums of capital compared to traditional loans but expect substantial returns on their investments.

Investors evaluate startups based on factors such as market opportunity, innovative solutions, competitive advantage, and the strength of the founding team.

They may also consider industry trends, revenue projections, and exit strategies when assessing investment opportunities.

Pitching to Venture Capitalists and Angels:

- Prepare a compelling pitch that outlines your startup’s value proposition, market opportunity, and competitive landscape.

- Tailor your presentation to resonate with investor interests and demonstrate a clear path to profitability and scalability.

- Highlight your team’s expertise, achievements, and milestones achieved to date.

- Anticipate tough questions and objections, and be prepared to articulate how investment funds will be utilized to achieve strategic growth objectives.

- Build relationships with investors through networking events, industry conferences, and introductions from mutual connections.

By effectively pitching to venture capitalists and angels, startups can secure vital funding and strategic partnerships to accelerate growth and market expansion in 2024.

Exploring Small Business Administration (SBA) Loans

Small Business Administration (SBA) loans are instrumental in supporting startups and small businesses in 2024, offering favorable terms and government-backed guarantees:

Overview of SBA Loan Programs: The SBA administers several loan programs tailored to meet diverse business needs. These include:

- 7(a) Loan Program: The most common SBA loan program providing financial assistance for various business purposes, including working capital, equipment purchase, and debt refinancing.

- Microloan Program: Offers small, short-term loans up to $50,000 to startup and growing small businesses through nonprofit lending institutions.

- CDC/504 Loan Program: Designed for long-term, fixed-rate financing for major fixed assets such as real estate and equipment.

Each SBA loan program has specific terms, interest rates, and eligibility requirements tailored to different stages of business development and financial needs.

Eligibility Requirements and Application Process: Eligibility for SBA loans typically requires businesses to meet criteria such as being a for-profit entity, operating within the United States, and meeting size standards based on industry classification or revenue.

Startups must demonstrate the ability to repay the loan based on cash flow projections, business experience, and collateral availability.

The application process involves completing SBA forms, providing financial statements, business plans, and personal background information for all owners.

Applicants may also need to secure collateral and provide a personal guarantee.

Engage with an SBA-approved lender who will guide you through the application process and help navigate the complexities of SBA loan programs to secure financing that supports your startup’s growth objectives in 2024.

Alternative Financing Options

In 2024, startups have access to alternative financing options beyond traditional loans, including peer-to-peer lending platforms and online lenders:

Peer-to-Peer Lending Platforms: Peer-to-peer (P2P) lending connects borrowers directly with individual investors willing to fund loans.

These platforms facilitate borrowing without the intermediation of traditional financial institutions, offering competitive interest rates and flexible terms.

Startups can create profiles detailing their funding needs, business plans, and intended use of funds to attract potential lenders.

P2P lending platforms assess borrower creditworthiness based on personal and business credit scores, financial history, and repayment capacity.

By leveraging P2P lending, startups can access capital quickly and efficiently while diversifying funding sources beyond conventional banking channels.

Online Lenders and Their Benefits: Online lenders specialize in providing fast, convenient access to capital for startups and small businesses.

These lenders offer streamlined application processes, quick approval decisions, and funding disbursal within days.

Online lending platforms evaluate loan applications based on business performance metrics, such as revenue trends, cash flow stability, and industry-specific factors, rather than solely relying on credit scores.

They may offer unsecured loans or lines of credit with varying interest rates and repayment terms tailored to suit startup needs.

Additionally, online lenders provide valuable financial tools and resources to help startups manage cash flow, track expenses, and optimize financial health.

By exploring alternative financing options like P2P lending and online lenders, startups can secure the funding necessary to fuel growth and achieve business objectives in 2024.

Negotiating Terms and Conditions

Negotiating favorable terms and conditions for a startup business loan in 2024 is crucial to ensuring financial viability and sustainability:

Understanding Loan Terms and Fine Print: Before signing any loan agreement, thoroughly review and understand the terms and conditions outlined in the fine print.

Pay close attention to key aspects such as:

- Interest Rates: Understand whether the rate is fixed or variable and how it will impact your monthly payments.

- Repayment Schedule: Clarify the timeline for repayment, including any grace periods or penalties for early repayment.

- Fees and Charges: Identify all fees associated with the loan, including origination fees, late payment fees, and prepayment penalties.

- Collateral Requirements: Determine if collateral is required to secure the loan and assess the implications of using personal or business assets as security.

Tips for Negotiating Favorable Terms:

- Prepare for negotiations by researching current market rates and terms offered by multiple lenders.

- Use this information to leverage competitive offers and negotiate lower interest rates, reduced fees, or more favorable repayment terms.

- Highlight your startup’s strengths, such as strong revenue projections, a robust business plan, or industry expertise, to demonstrate creditworthiness and mitigate perceived risks.

- Consider seeking guidance from financial advisors or legal experts to navigate complex terms and ensure alignment with your long-term financial goals.

Negotiating effectively can lead to a loan agreement that supports your startup’s growth objectives while minimizing financial strain and maximizing profitability in 2024.

Preparing a Compelling Loan Application

Crafting a compelling loan application is essential for securing a startup business loan in 2024.

Here’s how to effectively prepare:

Essential Components of a Loan Application: A well-rounded loan application should include the following essential components:

- Executive Summary: Concisely summarize your business, funding needs, and how the loan will be used.

- Business Plan: Provide a detailed business plan outlining your market analysis, competitive landscape, revenue projections, and operational strategies. Emphasize how the loan will contribute to business growth and profitability.

- Financial Statements: Include current and projected financial statements, such as income statements, balance sheets, and cash flow forecasts, to demonstrate financial stability and repayment capacity.

- Credit History: Present personal and business credit scores to showcase creditworthiness and responsible financial management.

- Collateral: Detail any assets available as collateral to secure the loan, if applicable.

- Supporting Documents: Include legal documents, licenses, permits, and resumes of key team members to bolster credibility and competence.

Common Mistakes to Avoid: To enhance your application’s effectiveness, avoid these common pitfalls:

- Incomplete Information: Ensure all required fields and documents are completed accurately and comprehensively.

- Overlooking Credit Issues: Address any credit challenges upfront and explain mitigating factors.

- Lack of Clarity: Clearly articulate your business goals, use of funds, and repayment strategy to align with lender expectations.

- Ignoring Terms and Conditions: Read and understand all terms, fees, and conditions to avoid surprises later in the process.

- Neglecting Proofreading: Review your application for errors or inconsistencies that could detract from professionalism and credibility.

By carefully assembling these components and avoiding common pitfalls, you can strengthen your loan application’s appeal and increase the likelihood of securing the necessary funding to launch and grow your startup in 2024.

Seeking Guidance from Business Advisors

In navigating the complexities of securing a startup business loan in 2024, seeking guidance from experienced mentors and business advisors can be invaluable:

Role of Mentors and Advisors in Funding: Mentors and advisors bring a wealth of knowledge, experience, and industry insights that can significantly enhance your funding strategy.

They provide guidance on structuring your business plan, refining financial projections, and identifying suitable funding sources tailored to your startup’s needs.

Mentors and advisors often have extensive networks within the business and investment community, facilitating introductions to potential investors or lenders.

They offer valuable feedback and perspective throughout the loan application process, helping you navigate challenges and optimize your chances of securing financing.

Where to Find Business Advisory Services: Business advisory services are available through various channels:

- Incubators and Accelerators: These programs offer mentorship, networking opportunities, and sometimes access to funding resources for startups.

- Small Business Development Centers (SBDCs): SBDCs provide free or low-cost advisory services, including business planning, financial analysis, and access to funding workshops.

- Professional Networks: Join industry associations, networking groups, and online communities to connect with experienced entrepreneurs, investors, and advisors.

- Consulting Firms: Consider hiring specialized consulting firms that offer expertise in fundraising, financial management, and strategic planning tailored to startups.

By leveraging the guidance of mentors and advisors, startups can gain strategic insights, refine their funding approach, and build credibility with potential lenders or investors.

This collaborative approach enhances your ability to navigate the competitive landscape and secure the necessary funding to fuel growth and success in 2024 and beyond.

Legal and Regulatory Considerations

Navigating legal and regulatory considerations is essential when pursuing a startup business loan in 2024, ensuring compliance and protecting your business interests:

Compliance Requirements for Funding Sources: Different funding sources, whether traditional loans, government grants, or investor funding, have specific compliance requirements that startups must adhere to.

For example, government-backed loans like those offered by the Small Business Administration (SBA) require adherence to federal regulations and reporting standards.

Ensure you understand and fulfill all documentation, reporting, and operational requirements stipulated by your chosen funding source to maintain eligibility and compliance.

Legal Implications of Startup Loans: Startup loans involve legal agreements that outline rights, obligations, and liabilities for both parties.

Before signing any loan agreement, seek legal advice to review terms and conditions, including interest rates, repayment schedules, collateral requirements, and default consequences.

Understand the implications of personal guarantees, which may hold you personally liable for loan repayment if the business fails.

Safeguard your business’s legal interests by ensuring all contracts are clear, comprehensive, and reviewed by legal professionals to mitigate risks and protect your startup’s financial future.

By proactively addressing legal and regulatory considerations, startups can navigate the loan application process with confidence, mitigate potential risks, and maintain compliance with applicable laws and regulations in 2024.

This approach strengthens your business’s foundation and supports sustainable growth while minimizing legal challenges and uncertainties.

Conclusion: Strategies for Obtaining Startup Funding

Securing funding for your startup in 2024 demands careful planning, strategic decision-making, and leveraging a variety of financial resources.

Begin by assessing your eligibility with multiple lenders, considering collateral options, and determining a loan amount that aligns with your financial capabilities.

Thoroughly review and understand loan terms, including the implications of personal guarantees, and weigh the benefits and risks before proceeding.

A detailed business plan is essential, demonstrating your vision, market understanding, and growth potential to potential lenders and investors alike.

Explore diverse funding avenues such as government grants, microfinance, crowdfunding, venture capital, and SBA loans, tailoring your approach to match your business’s unique needs and growth trajectory.

Utilize alternative financing options like peer-to-peer lending and online lenders for flexibility and speed in securing funds.

Strengthen your credit profile and negotiate favorable terms to optimize financial outcomes.

Throughout the journey, seek guidance from experienced mentors and advisors who can provide strategic insights and valuable connections.

Address legal and regulatory considerations meticulously to ensure compliance and protect your business’s interests.

Finally, after securing funding, implement robust financial management practices, including budgeting, cash flow monitoring, and risk mitigation strategies, to sustain long-term financial health and facilitate successful loan repayment.

By adopting these strategies and maintaining a proactive approach to financial management, you position your startup for growth, resilience, and achievement of your entrepreneurial goals in 2024 and beyond.

Remember, each step taken toward securing funding and managing finances effectively contributes to the foundation of your startup’s success in the competitive landscape of business.

FAQs on Getting Startup Loans with No Money

Is it possible to get small business startup loans with no money?

It’s challenging but possible. Startups may need to rely on personal assets, collateral, or alternative financing options if they have limited initial capital.

How do startup business loans work?

Startup loans provide capital for new businesses to cover initial costs, operations, and growth. They typically involve an application process, loan approval based on creditworthiness and business plans, and repayment terms with interest.

Why is cash flow important to business lenders?

Cash flow shows a business’s ability to generate income to repay loans. Lenders assess cash flow to gauge financial health and loan repayment capacity.

Can you get an SBA loan with no money down?

No, SBA loans usually require a down payment or collateral. However, they offer favorable terms and lower down payments compared to conventional loans.

Can you get a no credit check business loan with no revenue?

It’s rare. Loans without credit checks often require collateral or higher interest rates. Some lenders may consider other factors like personal assets or business plans.

How do I get a startup business loan with no money?

Consider options like microloans, crowdfunding, grants, or personal savings. Build a strong business plan, explore funding sources, and demonstrate creditworthiness.

What do I need for a startup business loan?

Typically, a business plan, financial projections, credit history, collateral (if applicable), and personal financial information.

How much can I get for a startup business loan?

Loan amounts vary based on the lender, business plan, creditworthiness, and collateral. Startups may receive anywhere from a few thousand dollars to millions, depending on these factors.

Which banks offer startup business loans?

Banks like Bank of America, Wells Fargo, and Chase offer startup business loans, along with online lenders and credit unions.

How hard is it to get a small business loan for a startup?

It can be challenging due to risk factors associated with startups. Success often depends on having a solid business plan, strong credit, collateral, and demonstrating repayment capability.